Quit Rent And Assessment Malaysia

Find out everything you need to know about property taxes in malaysia.

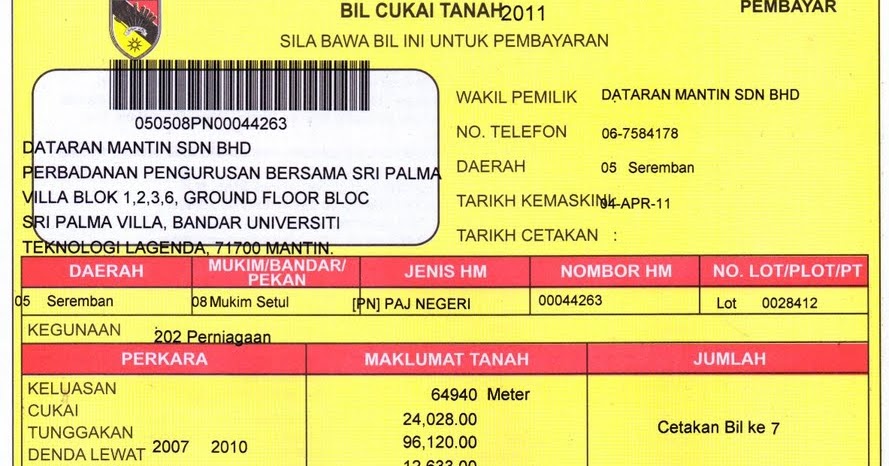

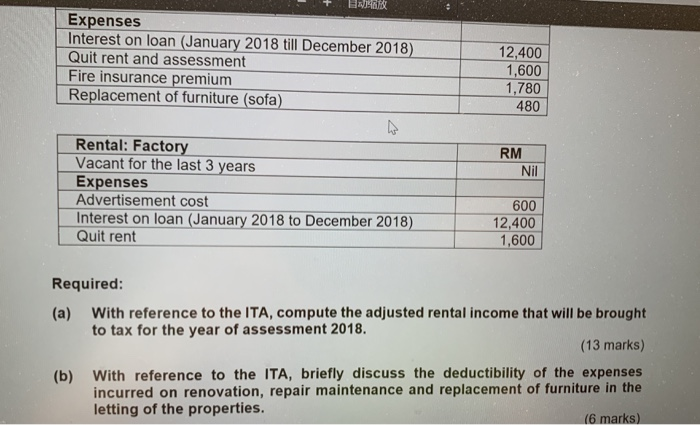

Quit rent and assessment malaysia. Referred to as cukai tanah in malay quit rent is the payment that owners of local properties make to the malaysian government through the land office or pejabat tanah dan galian ptg. Any repairs or improvements made to a property that increases its value impact assessment tax. What is quit rent cukai tanah.

Quit rent is assessed as a chargeable rate related to the total amount of land included as part of a property. Of course if you live in sarawak you enjoy a happy bonus. This payment is calculated by multiplying the size of an owned property in square feet or square metres by a specified rental rate.

Maybe you re not even sure what cukai tanah is. Quit rent cukai tanah is a tax imposed on private properties. Quit rent quit rent or quitrent is a tax or land tax imposed on occupants of freehold or leased land in lieu of services to a higher landowning authority usually a government or its assigns.

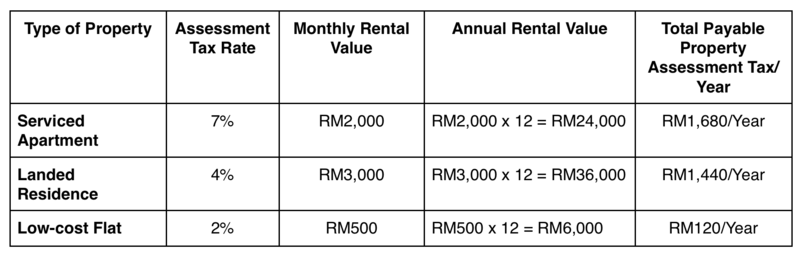

How much quit rent do i have to pay. Rent and returns. Local councils in each malaysian state levy assessment tax against those who provide residential housing units.

Whether the quit rent for land held for property development should be capitalised as part of the cost of land or expensed off in profit or loss. In that case this is the article for you. Information about the property taxes assessment tax quit rent stamp duty and real property gains tax paid by home owners and tenants in malaysia.

Accounting treatment of quit rent for land held for property development the issue. It is a form of land tax collected by state governments and is imposed on owners of freehold or leased land. It must be paid by the landlord to the.

Learn about these 5 different property taxes that you absolutely need to know about. Under feudal law the payment of quit rent latin quietus redditus pl. Redditus quieti freed the tenant of a holding from the obligation to perform such other services as were obligatory under feudal.

The amount of an annual assessment tax hinges on the value of the property which the state determines in most cases by the amount of rent paid on the property during the course of a year. The submitter claimed that there is divergence in practice on the treatment of quit rent for land held for. Current accounting practice as observed by the submitter.

Besides the assessment tax the other main cost associated with property and land ownership in malaysia is quit rent or cukai tanah. Quit rent was abolished for residential owners in the state in 2016.