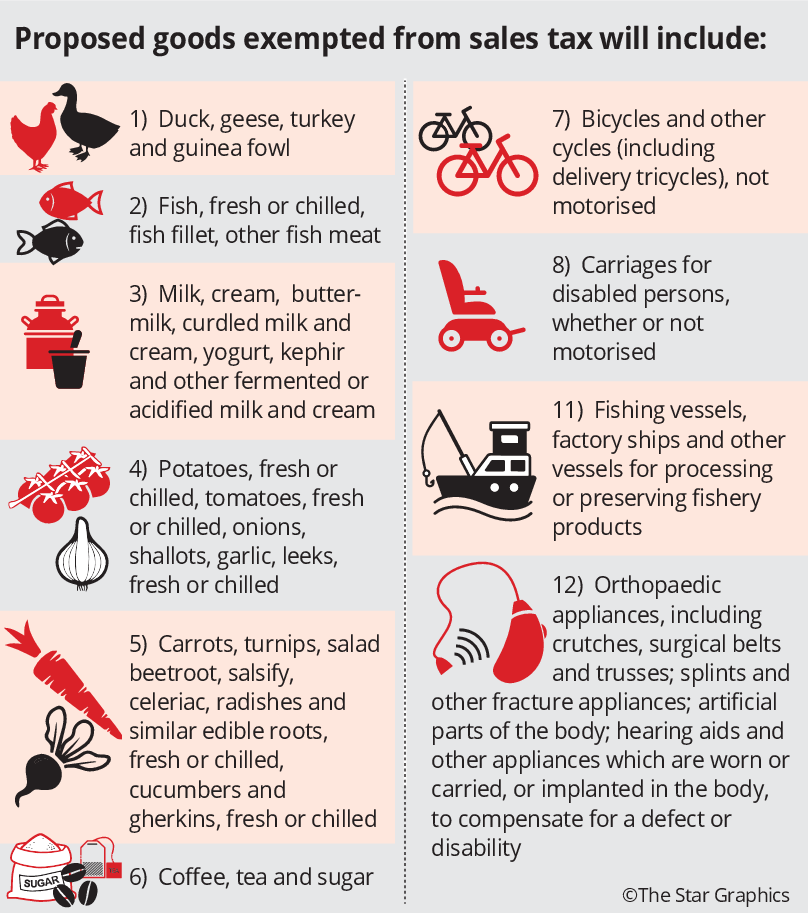

Proposed Goods Exempted From Sales Tax

In a very recent decision the supreme court sc has laid down the principles for claiming exemption under the central sales tax act 1956 csta with regard to the penultimate sale of goods by a dealer to an exporter who effects the actual exports of goods from the country state of karnataka vs azad coach builders pvt ltd 2010 vil 12 scb cb.

Proposed goods exempted from sales tax. Similarly the sale of life saving drugs or books meant for reading in different state governments were exempt from taxes. Please refer to sales tax goods exempted from tax order 2018 and sales tax rates of tax order 2018. Prepared food 6.

0101 30 10 00 pure bred breeding animals 0101 30 90 00 other 0101 90 00 00 other 01 02 live bovine animals. Proposed goods exempted from sales tax. The government has proposed changes through finance supplementary second amendment bill 2019 to exemptions allowed under sales tax laws to various sectors.

Please refer to sales tax goods exempted from tax order 2018 and sales tax rates of tax order 2018. Such exemptions on specified goods or services are. Live animals fish seafood and certain essential food items including meat milk eggs vegetables fruits bread.

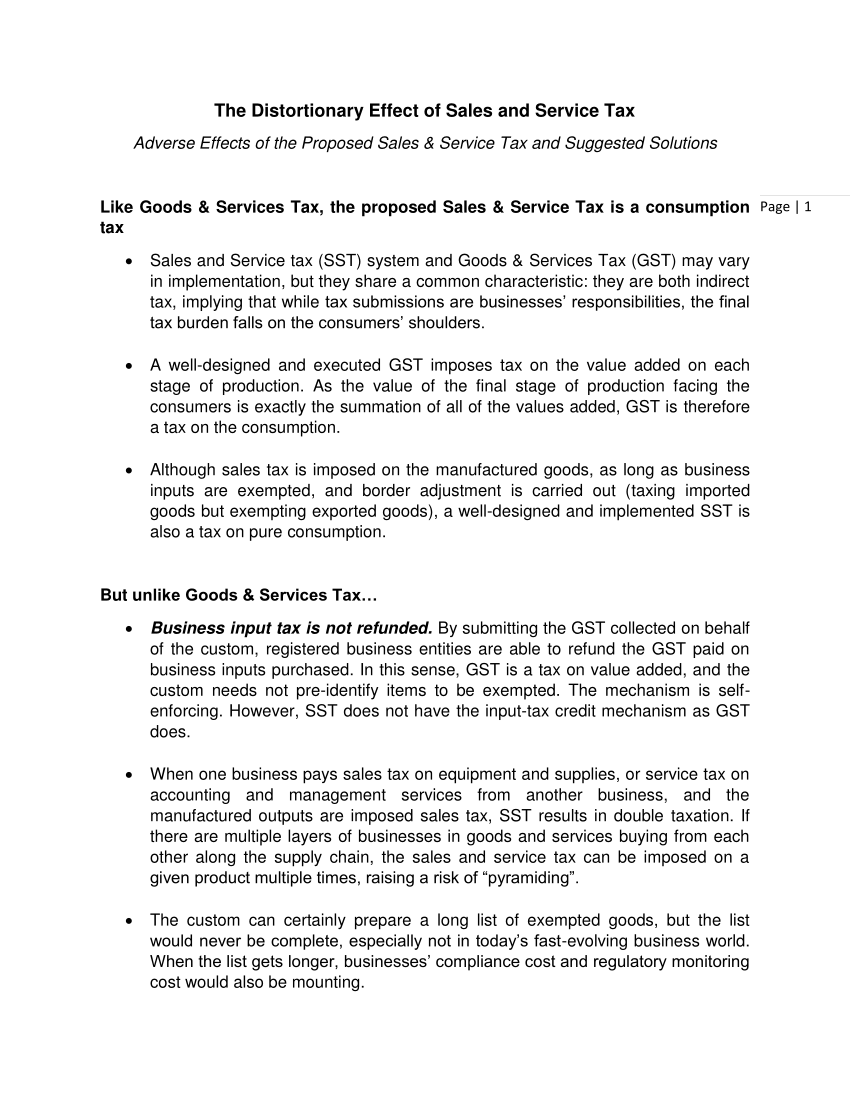

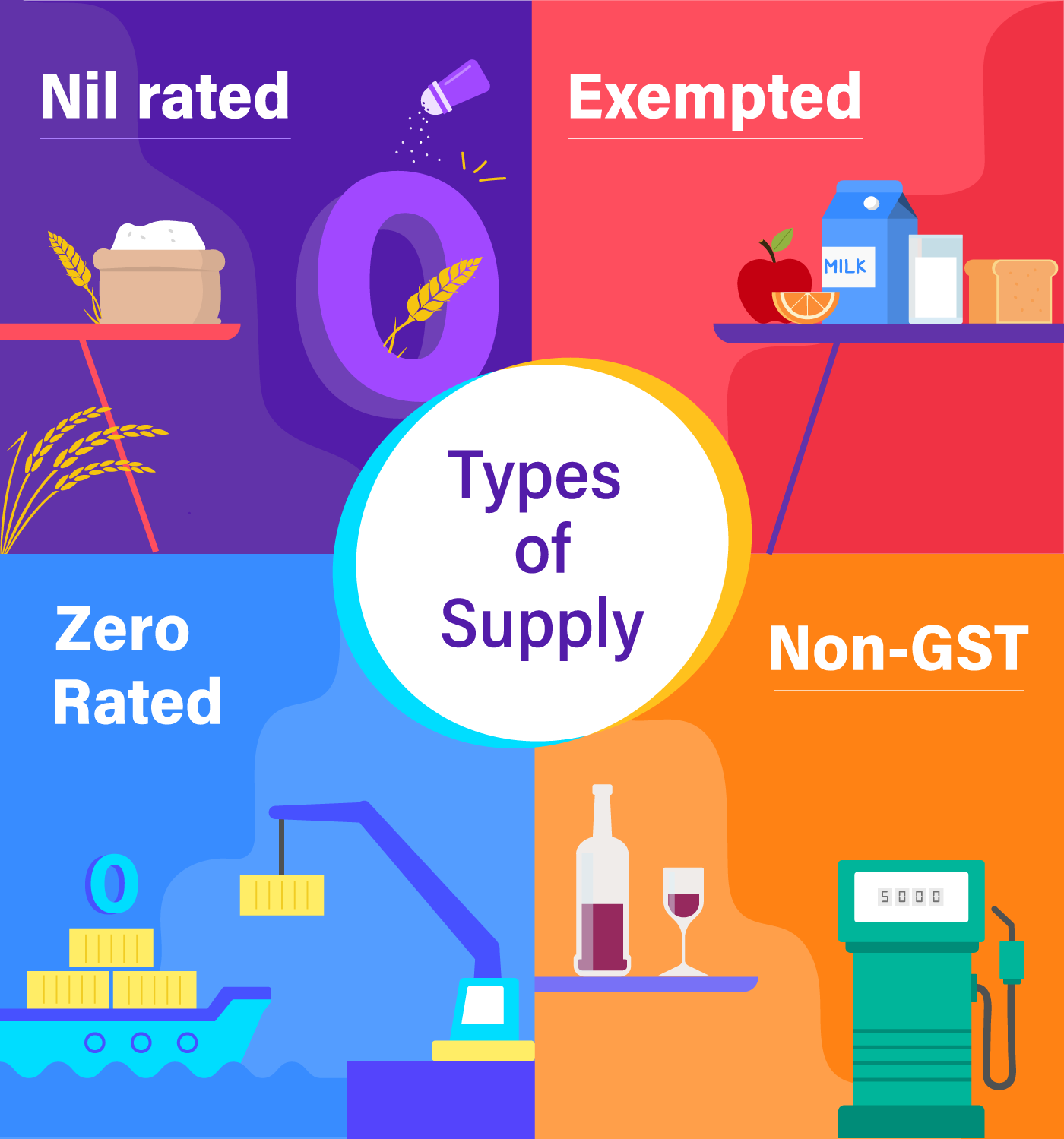

Clothing 6 25 groceries exempt. Like all such taxes there are few exceptions even under gst where goods or services are exempt from tax liability. All goods manufactured for export are exempted from sales tax.

Restaurant meals may also have a special sales tax rate. This guide merely serves as information. Guide on proposed sales tax rates for various goods 25 08 2018 version r 2 0.

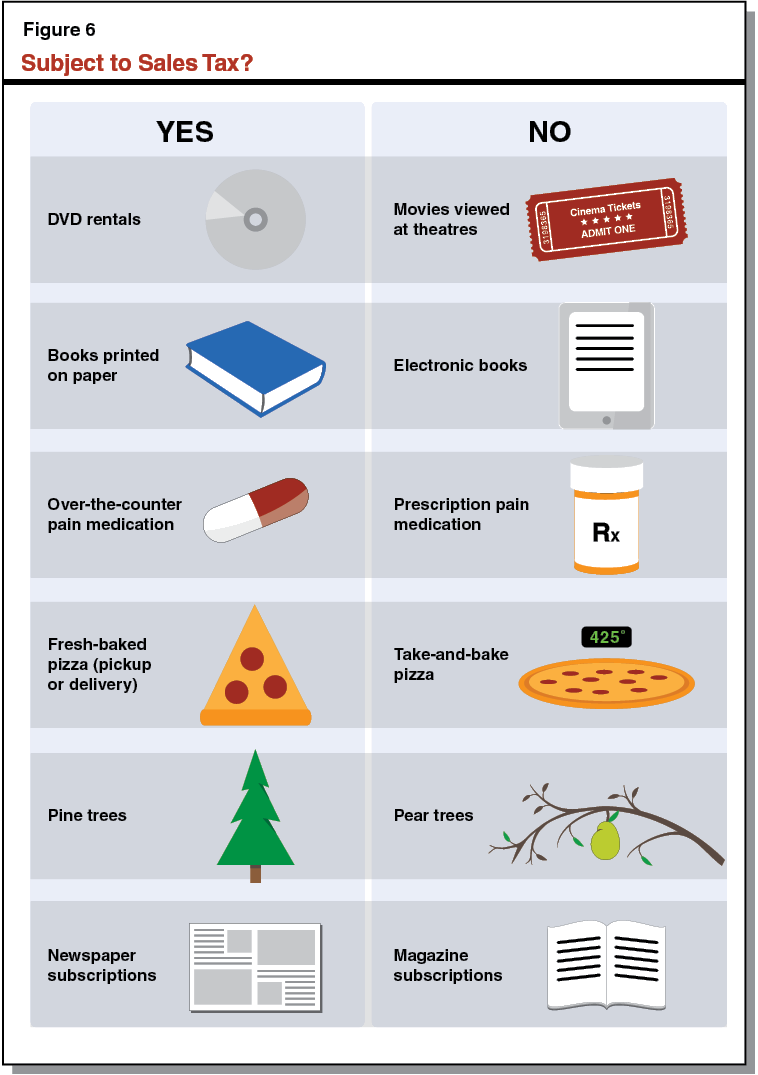

An example of an item which is exempt from texas sales tax are items which were specifically purchased for resale. Page 2 of 132 for further enquiries please contact customs call center. For instance under the service tax regime clinical and education services were exempt from service tax.

Guide on proposed sales tax rates for various goods 25 08 2018 version r 2 0. 1 300 88 8500 general enquiries operation hours monday friday 8 30 a m 7 00 p m email. 2 jadual a schedule a heading 1 subheading 2 description 3 01 01 live horses asses mules and hinnies.

Books magazines newspapers journals and periodicals. 0101 21 00 00 pure bred breeding animals 0101 29 00 00 other 0101 30 asses. Here are the special category rates for texas.

Ferguson chartered accountants following changes have been proposed to be made in the sixth schedule of sales tax act 1990. Many states have special lowered sales tax rates for certain types of staple goods such as groceries clothing and medicines. According to comments of pwc a.

This guide merely serves as information. Page 95 of 132 name of goods heading chapter exempted 5 10 printed fancy card 49 09 49 printed greetings card 49 09 49 printed label 49 11 49 printed postcard 49 09 49.