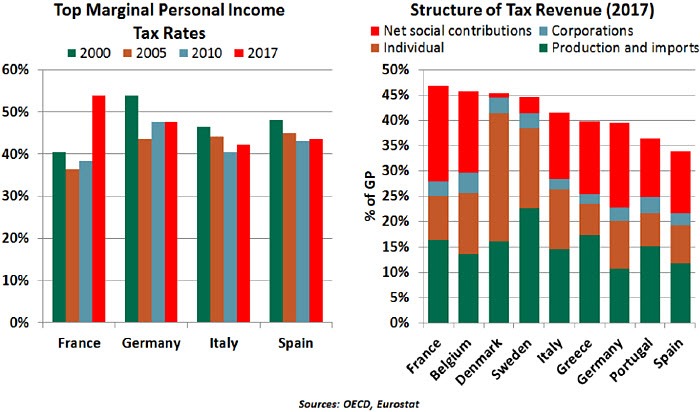

Personal Income Tax Rates By Country

13 standard income tax 26 pension fund charges 2 9 social security charges 5 1 medicare for non residents.

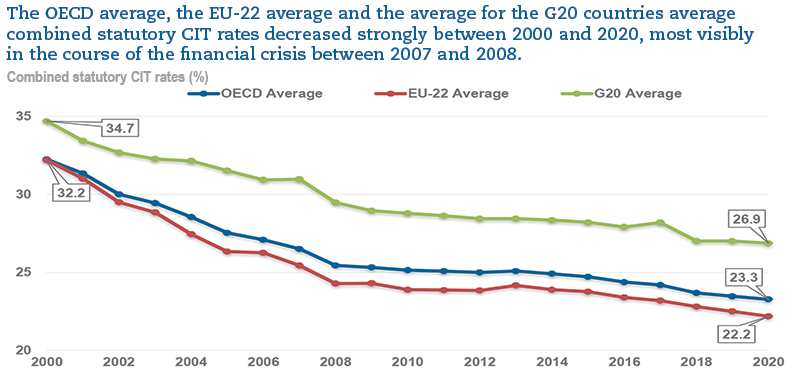

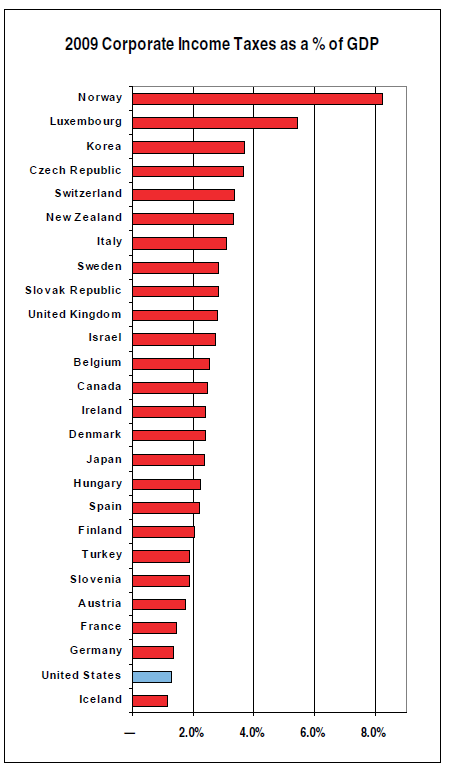

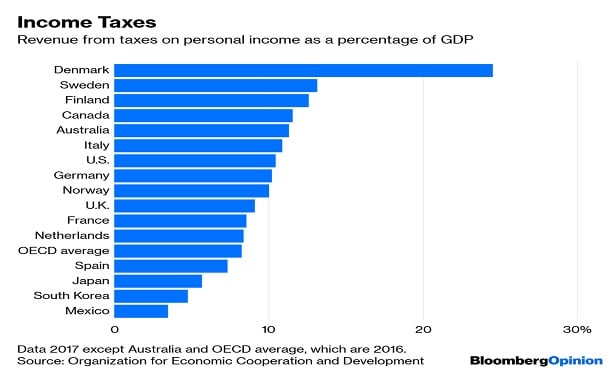

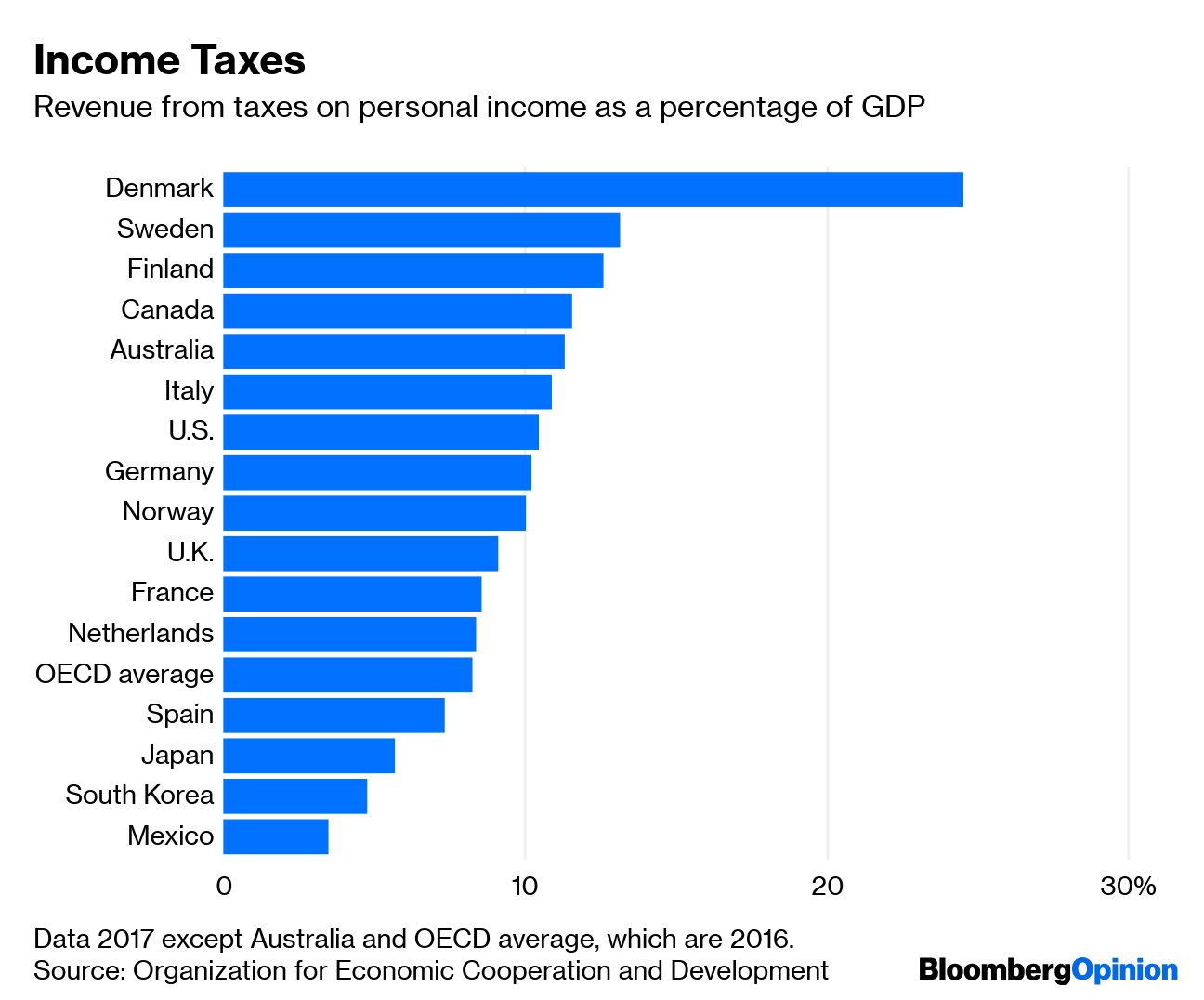

Personal income tax rates by country. The country s personal income tax rate had an average value of 53 91 from 1995 until 2019 which if it still were at the same level would rank it even higher on our list of the highest individual tax rates by country. List of countries by personal income tax rate provides a table with the latest tax rate figures for several countries including actual values forecasts statistics and historical data. Chapter 3 tables 3 7 to 3 14 taxes as of gdp and as of total tax revenue.

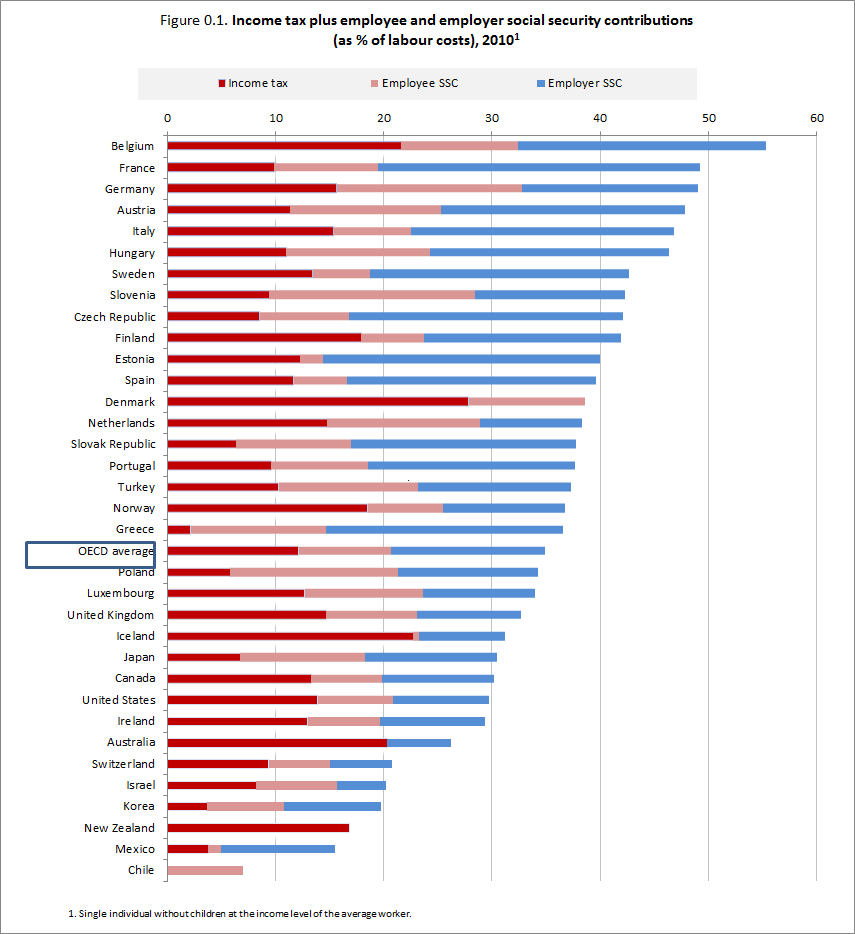

Kpmg s individual income tax rates table provides a view of individual income tax rates. In addition the dutch government also charges a capital gains tax of 25 a land transfer tax of 6 and an inheritance tax of up to 40. Let s look at the countries with the highest all in average personal income tax rates at the average wage for a single person with no children.

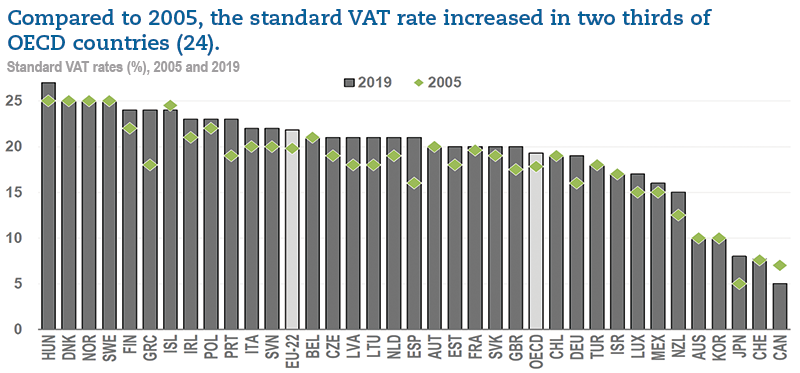

Oil rich countries like oman and qatar are also in the same boat. Chapter 4 countries tax revenue and of. This page displays a table with actual values consensus figures forecasts statistics and historical data charts for list of countries by personal income tax rate.

30 0 30 18. Use our interactive tax rates tool to compare tax rates by country or region. Chapter 3 table 3 2 total tax revenue in us dollars at market exchange rate.

35 standard income tax 1 8 social security charges 20 standard rate 10 books certain items of food and children goods 0 house or flat taxation in russia rwanda. The top five are germany 39 3 belgium 39 3. Personal income tax rate income tax plus mandatory pension social security and state funded medical care payments all of which are added as a percentage of income up to a maximum is 52 for people under the age of 65 on all income over 66 000.

Chapter 4 countries tax revenue and of gdp by level of government and main taxes. Tax rates are checked regularly by kpmg member firms. Alaska generates 90 of its revenue from its oil and gas industry and boasts a 0 income tax rate.

/2019GlobalTaxRateAveragesbyRegion-343a58758a514d4a8a64ee3e7b81e4bd.jpg)