Personal Income Tax Malaysia 2019

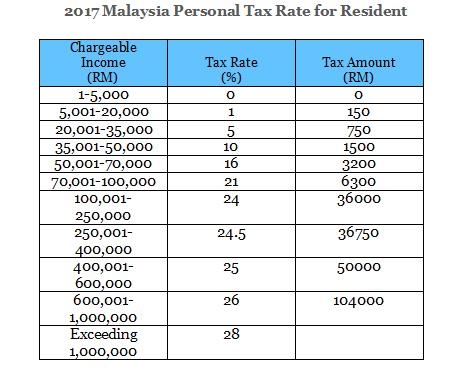

Based on this amount the income tax to pay the government is rm1 640 at a rate of 8.

Personal income tax malaysia 2019. 2018 2019 malaysian tax booklet personal income tax. This will save you time and frustration by keeping you away from the crowds. Taxes including personal income tax expenses and limitations are reviewed by the government in malaysia periodically and typically updated each year.

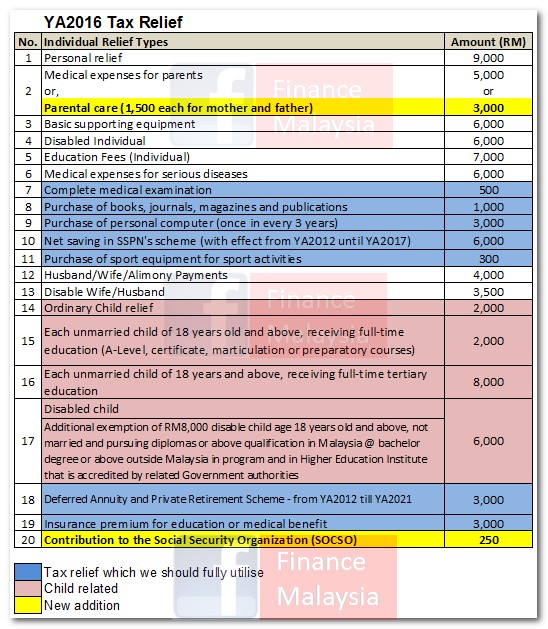

However if you claimed rm13 500 in tax deductions and tax reliefs your chargeable income would reduce to rm34 500. Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epf deductions has to register a tax file. Here are the income tax rates for personal income tax in malaysia for ya 2019.

There are no local taxes on personal income in malaysia. Income tax in malaysia in 2019. Income tax deadline 2019.

2018 2019 malaysian tax booklet 22 rates of tax 1. How to file your personal income tax online in malaysia. If you re still in the dark here s our complete guide to filing your income taxes in malaysia 2019 for the year of assessment 2018.

Malaysia personal income tax rate is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a max of 28. Gone are the days of queuing up in the wee hours of the morning at the tax office to complete your filing. In malaysia for at least 182 days in a calendar year.

You can now pay your taxes and get your tax returns online or through other methods. Who needs to pay income tax. Personal income tax tax residence status of individuals.

In malaysia for a period of less than 182 days during the year shorter period but that period is linked to a period of physical presence of 182 or more consecutive days. An individual is regarded as tax resident if he meets any of the following conditions i e. For example let s say your annual taxable income is rm48 000.