Partnership Tax Computation Malaysia

This means that low income earners are imposed with a lower tax rate compared to those with a higher income.

Partnership tax computation malaysia. 14 august 2015 director general s public ruling section 138a of the income tax act 1967 ita provides that the director general is. Llp have a similar tax treatment like company where chargeable income from llp will be taxed at the llp level at tax rate of 24 generally. Bilateral credit and unilateral credit 17 director general s public ruling section 138a of the income tax act 1967 ita provides that the director general is empowered to make a public ruling in relation to the application of any provisions of the ita.

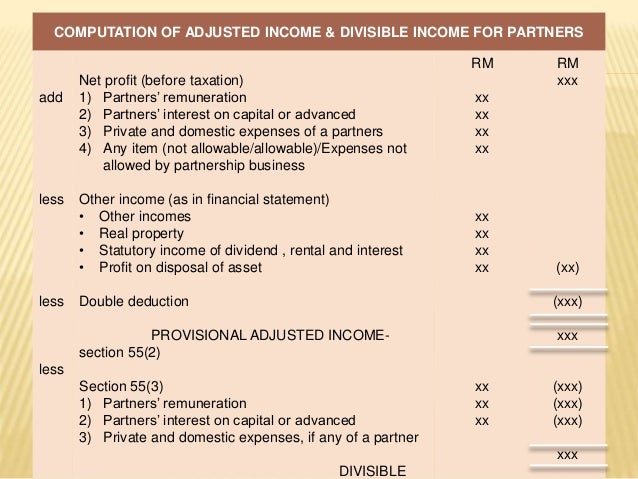

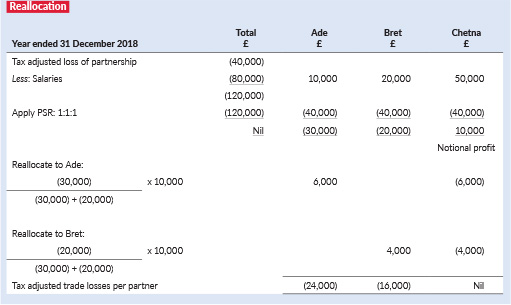

Hence each partner is required to pay for their own income tax even though they are practising partnership. Husband and wife have to fill separate income tax return forms. B first listed partner in the partnership agreement or c if no agreement the name listed first.

There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make sure you. Tax treatment of llp. The system is thus based on the taxpayer s ability to pay.

According to the income tax act 1967 the main partner must. Company while registered companies are subject to corporate tax other types of businesses such as sole proprietorships and partnerships are also liable to income tax. Tax treatment of partners of a limited liability partnership 18 12.

5 201 date of publication. A public ruling is published as a guide for the public and officers of the. 2link dot com view my complete profile disclaimer.

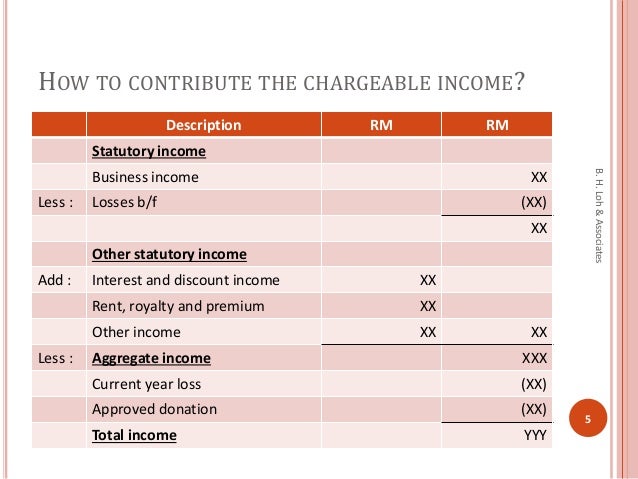

Another tax requirement for llps in malaysia is given by the estimate of tax payable in a financial year. For partnerships income is distributed to partners for individual tax computation sole proprietorship partnership vs. Partnership tax comp slide no.

There is no withholding tax on. Bilateral credit and unilateral credit 18 13. Updates and amendments 19.

Law governing the taxation of the partnership. Posts atom 2link back to. Precedent partner is also responsible for informing lhdnm officially if the partnership ceases changes to a sole proprietorship private limited company.

Malaysia personal income tax calculator for ya 2020 malaysia adopts a progressive income tax rate system. Public ruling inland revenue board of malaysia taxation of limited liability partnership no. Profits paid credited or distributed to partners in the llp are exempt from tax.

A partner resident in malaysia. To check and sign duly completed income tax return form. All supporting documents like.

Taxation for limited liability partnership llp in malaysia. Blog archive 2010 1 february 1 partnership tax comp slide no. Posted by 2link dot com at 6 57 pm no comments.

It is important to know that in the situation of a llp that is registered in malaysia the income tax will be applied at a rate of 20 provided that the capital contribution of the partnership is of maximum rm 2 5 million. In malaysia partnership income is s 4 a business income. To submit the income tax return form by the due date.

Partnership tax computation monday february 1 2010.

%202.png)